Today Show – Video – How To Live to 100

Transcript of the above video:

Back now at 8:19 with more of our special series, how to live to 100. this morning we’re focusing on the science of longevity. Reaching the century mark, is it possible for everyone? here’s nbc’s chief medical editor.

Reporter: There are approximately 70,000 centenarians living in the united states today. And some scientists say that the first person who will live to their 150th birthday had already been born. But who are these centenarians going to be and can we increase our chances of becoming one of them?

The signs of aging is becoming really popular because there’s so much more out there as a consumer to take control of their health and manage their aging.

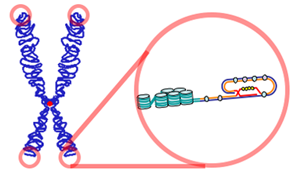

Reporter: In 2009 three scientists won the nobel prize for the research on one of the most exciting developments on the aging forefront. Telomeres are structures on the chromosomes that shorten as people age. Think of them as a plastic tips on a shoestring. People with shorter telomeres are more likely to develop illnesses and die earlier. The science is far from complete but some laboratories have seized this opportunity and are offering tests that measures a person’s telomere length. This laboratory is the only lab in the united states to offer telomere testing, the cost $200.

It can serve as a wake-all call for some people. It’s a measure on how well you’re ageing on the inside. So for some people it can tell them that maybe they’re aging faster than they expect and maybe they can make some major lifetime changes.

Reporter: I decided Toby own ginuinea pig and see what my telomere says about me. I hope i slide out of home plate. That’s all i’m asking for. But if our telomeres are short, is there a way to make them longer? This doctor at the albert einstein college of medicine is focusing their research but is hoping hoping catches up.

Why is everyone looking at telomere?

People think it can serve as a bio marker for prediction of how long they are going to live. But, like predictions, can be this side or this side.

Reporter: He believes their test is for real.

It does not tell you when you’re going to die or how long you have to live. It just tells you how well you’re aging and help you manage that.

Reporter: Is it safe to say that this is an extraordinarily exciting development in the lab but it is not ready for public use?

Yes. We don’t have enough information to make it accurate for prediction.

The future is there?

The future is there.

Reporter: With that in mind, i’m ready to get my result. Like any good parent, i want one wish, i want to predisepredisease my children, that’s it.

Chief Medical Officer here. Let’s hear Nancy’s results. Good morning.

Good morning.

You don’t know what the results are?

I don’t have a clue.

We’re going to put them up on the monitor explain, Tanya, how Nancy did.

Nancy is the red box. And the black line is the average telomere length of her age. If you look at her box and you track it over to the green dot, that’s her actual age based on her telomere lengths.

So i’m 70 right now even though i’m 59?

I’ll make you feel better. There’s a variance here, 8% to 10% error when you get older. It’s plus or minus seven years. Your range really is 63 to 77, with an average of 70. But your telomeres are shorter than someone your same age.

You are likely to have —

A shorter life expectancy.

That’s sobering.

It’s a variable. I could get hit by a bus this afternoon.

Please don’t.

Thank you.

But what’s interesting to me, looking at that, is that i’m probably the first in my generation to really be affected by everything environmental. I’m a fast food kid. I grew up around cigarette smoke. you know, i wasn’t perfect in college. I’ve had, you know, some excess alcohol in my past.

But you workout —

But i’m not stupid. Every one of those things takes a hit. That to me says you can override your genes and environmental factors. Perhaps even though i’ve cleaned up my act since then, i live a pretty good life now, there’s still room for improvement.

There is your genes are set but how your genes are translated and transcripted you have an affect with your lifestyle choices, which as we age affect things like being able to look after your own home.

On that point then you talk about what you can do as for nutritional profile tests, take your medication, exercise, decrease body fat, meditate, reduce stress. That last point —

Stress is huge. I must tell you, this doesn’t shock me.

No.

It’s sobering to me.

It shocked me, though.

It’s sobering to me. I wish it weren’t what it is. But i can’t tell you that i’m absolutely shocked. I expected it to not get a great result and to tell myself to get my act together.

Does that mean — for $200, anyone can have this done? The question is, is it worth it? Are you — do you think it was worth it for you to now know this sobering number, Nancy?

Yes, this to me is a little bit like getting a stress test or angiogram. It’s a component. Let’s check back a year later and see if we can make it better.

Let’s do that.

Planning For Retirement, Just Might Have Gotten A Bit Harder

Do you require some assistance in retirement planning? You are not alone. There are many options for you to choose from, and it can be confusing. These tips can help reduce the stress associated with retirement planning. These tips will help reduce your stress level.

One of the main forms of retirement planning that provides the best form or ongoing returns, is property investment. Choosing the right property, at the right time and in the right location can help you to retire with comfort and financial security. One of the best ways to do this is to consider off the plan apartments in Sydney, Melbourne or Brisbane. Buying off the plan properties gives you a substantial discount on the final selling price of the property. So for the long term plan, investment properties managed well, provide an excellent vehicle for your golden years. Before we consider this further, you might like to think about semi-retirement.

If you are ready to retire but think you can’t afford it, consider a partial retirement. This means that you should work where you already do but just part time. This will allow you to continue to bring in some income, while beginning retirement, which can always be expanded upon in the future.

Make routine 401k contributions and maximize any available employer matching funds. This lets you sock away pre-tax money, so they take less out from your paycheck. If you have a plan that has your employer matching the contributions you make, it is basically free money.

Use the extra time you have during retirement to increase your fitness level. You have to keep yourself healthy to ensure your medical costs don’t go up. If you are physically fit, you will enjoy your retirement more.

Are you overwhelmed and thinking about why you haven’t started to save? Saving anything is better than saving nothing.

Look at the savings plan for retirement that your employer offers to you. If they offer a 401K plan, take advantage of it. Research your plan carefully, what you can contribute and when you can access the money.

Of course you want to scrape up as many total retirement dollars as you can over the years, but don’t neglect choosing the right investment vehicles for them. Avoid investing in just one type of investment, and diversify instead. Diversification is less risky.

If possible, consider putting off tapping your Social Security benefits. If you wait, you can get more in the monthly allowance they give you, which makes being financially comfortable possible. Having multiple sources of income is the best way to accomplish this.

Look at your portfolio for retirement quarterly. This can prevent huge losses in the future. You aren’t able to put your cash in the best places if you don’t do it enough. Work closely with an investment adviser to choose the right allocation of your money.

When you are approaching retirement, downsize. While you may believe that you have a good handle on your financial future, unexpected events often occur. Big expenses and medical bills can happen at any point, and they can be very hard to deal with once you’re retired.

Think about a health plan for the long-term. For some people, poor health means they need more healthcare.

Knowing what you are likely to need money-wise makes saving easier. Some simple math can help you figure out how much to put away each week or month.

Within your own social circle, you can enjoy activities that retirees do. It also supplies you with a support group on which you can rely when the need arises.

Don’t think that Social Security benefits will cover the cost of living. While they will provide you with 40 % of what you make now, it costs more than that to live. Most people need at least 70 percent of the pre-retirement income for a comfortable retirement, and that is 90 percent for those with low income.

Should you retire and need to save money, downsizing is a good idea. You may have your mortgage paid off but your house will still have expenses such as taxes, utilities and repairs.

What kind of income will be available to you when you are ready to retire? Calculate Social Security, interest on your savings, and any pension plans that you have accumulated. The better you understand your retirement, the easier it is to plan for. Now is the time to start planning for your retirement dreams.

Learn what you can regarding Medicare before you are eligible to enroll. Perhaps you have additional insurance now, making it necessary to see how they will work together. Learning more about the topic helps ensure full coverage.

Avoid the pitfalls of having to depend solely on Social Security for your retirement. It can help you financially, but many can not live of it nowadays. These benefits will not even be half of what you have previously earned.

Be sure to designate Power of Attorney for health care and financial decisions. Such people will be able to act on your behalf when or if you are incapacitated. Your designated appointee would be able to make decisions for you and to pay any bills and protect your assets.

Put away at least 10 % of your income per year. This will help you plan for the future. If you can, try for 15 percent. Don’t let your other bills suffer as a result.

Is a very large home necessary post-retirement? If not, consider downsizing. Because you won’t need to save as much to do what you want, it is smart to downsize.

Have you thought about working while you are in your retirement years? Many people don’t like to have a lot of free time on their hands.

These tips were the beginning; continue to learn along the way. Following these tips will help you prepare for a retirement you can enjoy. Planning ahead will help you live well with your fixed income.

These tips can help reduce the stress associated with retirement planning. Look at the savings plan for retirement that your employer offers to you. Most people need at least 70 percent of the pre-retirement income for a comfortable retirement, and that is 90 percent for those with low income.

The better you understand your retirement, the easier it is to plan for. Now is the time to start planning for your retirement dreams.